Leading underwriter of Sustainable Bonds

Sustainable acting and managing are founding principles and part of the Cooperative DNA

Corporate Responsibility has a long tradition at cooperative banks. Accordingly, at DZ BANK, as central institution of the cooperative network, sustainability is anchored in our DNA. Sustainable Finance is therefore an essential part of our core business. With our Sustainable Financing products, we take into account environmental, social and ethical criteria and thus specifically promote the sustainable development of our society and the responsible use of limited resources.

Accordingly, we at DZ BANK have a team within our Capital Markets division that is dedicated to Sustainable Finance. For many years, the bank's DCM team has been actively contributing to the further development of the market for Sustainable Finance as a reliable partner for issuers. This was done, among other things through innovations such as ESGlocate (an innovative allocation tool for issuers of Sustainable Bonds), the KPI Library (a tool for the rapid identification of possible KPIs for Target-Linked structures) or FrameNow (an automated construction kit that supports and accelerates the creation of Sustainable Finance Frameworks).

Our ESG experts provide issuers with holistic support in the context of a Sustainable Finance Transaction, i.e. in structuring, placement and reporting. In addition to our activities in the primary market, we also develop and shape the topic of Sustainable Finance in numerous national (e.g. Forum Nachhaltige Geldanlagen (FNG), Green and Sustainable Finance Cluster Germany (GSFCG), Sustainable Finance Advisory Board of the German Federal Government) and international (Climate Bonds Initiative, ICMA Green Bond Principles, UN PRB) initiatives and working groups.

2025: A tough challenge for the Sustainable Bond market?

Crisis-resistant - again this year?

For a long time, the Sustainable Bond market knew only one direction: always forward, never back. In 2020 and 2022, it suddenly faced its first major challenges: COVID-19 and a new geopolitical reality, coupled with many economic obstacles. This was seen as a sword of Damocles by many detractors.

However, the relatively young market has defied its critics and mastered these uncertain times with flying colors. At the epicenter of a pandemic, it fought his way back to new heights. And its response to the new geopolitical and economic world has been one of qualitative growth.

In 2025, the Sustainable Bond market will be put to the test again. The headwind is anything but light at the moment: the setback for ESG in the US, ongoing geopolitical and economic uncertainty around the globe, the question of how to reconcile sustainable transformation and competitiveness in Europe as well as a regulatory environment that remains complex and difficult to navigate.

In this area of turbulences, how is the Sustainable Bond market reacting? As a result, the volume of new Sustainable Bond issuance in the first six months of the year was down by around 5% year-on-year. However, from our perspective, there is no reason to bury our heads in the sand. In the medium to long term, the opportunities outweigh the risks. And the market is also experiencing enough tailwind to avoid going off track in the future. Given the global nature of the sustainability movement, capital markets will continue to respond to real-world challenges beyond the politics of Washington. We believe that despite, or perhaps because of, the changing political landscape and the backlash against sustainable finance, investing in Sustainable Bonds remains attractive for investors on the international stage seeking long-term value creation.

Don’t worry – be optimistic!

While the debate on Sustainable Bonds may focus on challenges and risks in the short term, and voices critical of Sustainable Finance/ ESG may be raised in some parts of the world, we should instead devote ourselves to the many, many opportunities that the market offers.

COP30 will be a “COP of transition plans of sovereigns.” As governments around the globe have already started to prepare their next round of NDCs, Sustainable Bonds by sovereign issuers will be an important catalyst for accelerating future market development. And investor appetite for Sovereign Sustainable Bonds remains strong. With first-time issuers in the starting blocks and established issuers, particularly from Europe, expanding their sustainable finance activities, we could see new record levels. A look at the figures reveals great potential. There are about 170 countries that issue sovereign debt, and so far, only about 60 of them have come to the market with a Sustainable Bond. So, there are still many who have not ventured into sustainable funding.

Although Sustainable Finance/ESG will find itself on shakier ground in the US in the coming months and Sustainable Bond issuance by US issuers is expected to decline, this will not be the death knell for the global market. First, and unfortunately, the US has already lost ground in the global Sustainable Bond market in recent years. The action is already elsewhere and will be elsewhere in the future. Europe will remain in the driver's seat in terms of new sustainable bond issuance. It is also home to the largest number of sustainable and responsible investors in the world. With an estimated share of more than 40% of the new issuance volume in 2025, it will continue to be the largest source of sustainable debt on the globe. In fact, as the net-zero targets set by most European governments require significant funding, we expect Sustainable Bond issuance in Europe to continue to grow. In addition, we do not expect many European financial institutions that issue Sustainable Bonds to pull out of net-zero initiatives, in contrast to their US counterparts. It will also be worth keeping a close eye on Asia, which is increasingly becoming a robust source of growth of sustainable debt.

Current developments are also likely to further strengthen the role of the euro in the sustainable bond market. With an estimated share of more than 40% of the new issuance volume in 2025, it will remain the most used and sought currency in the global Sustainable Bond market in 2025 and beyond.

With new records in Sustainable Bond maturities set to be reached in the next two years, a large proportion of which will be Green Bonds, there will be an enormous refinancing requirement, especially for European issuers. It is to be expected that in this context, several issuers will update or expand their frameworks to include new categories or instruments.

Efforts to simplify the regulatory landscape and increase its usability could also provide further growth impetus. Many issuers support a balanced approach to sustainable finance regulation, which will help the market grow, and warn against over-regulation and excessive complexity, which can have negative effects. Regarding taxonomies, many issuers call for harmonization, usability, and interoperability, but not uniformity. Sustainability always has a cultural component. Hence, there is no "one size fits all" solution.

No new highs, but not a leap off the cliff, either

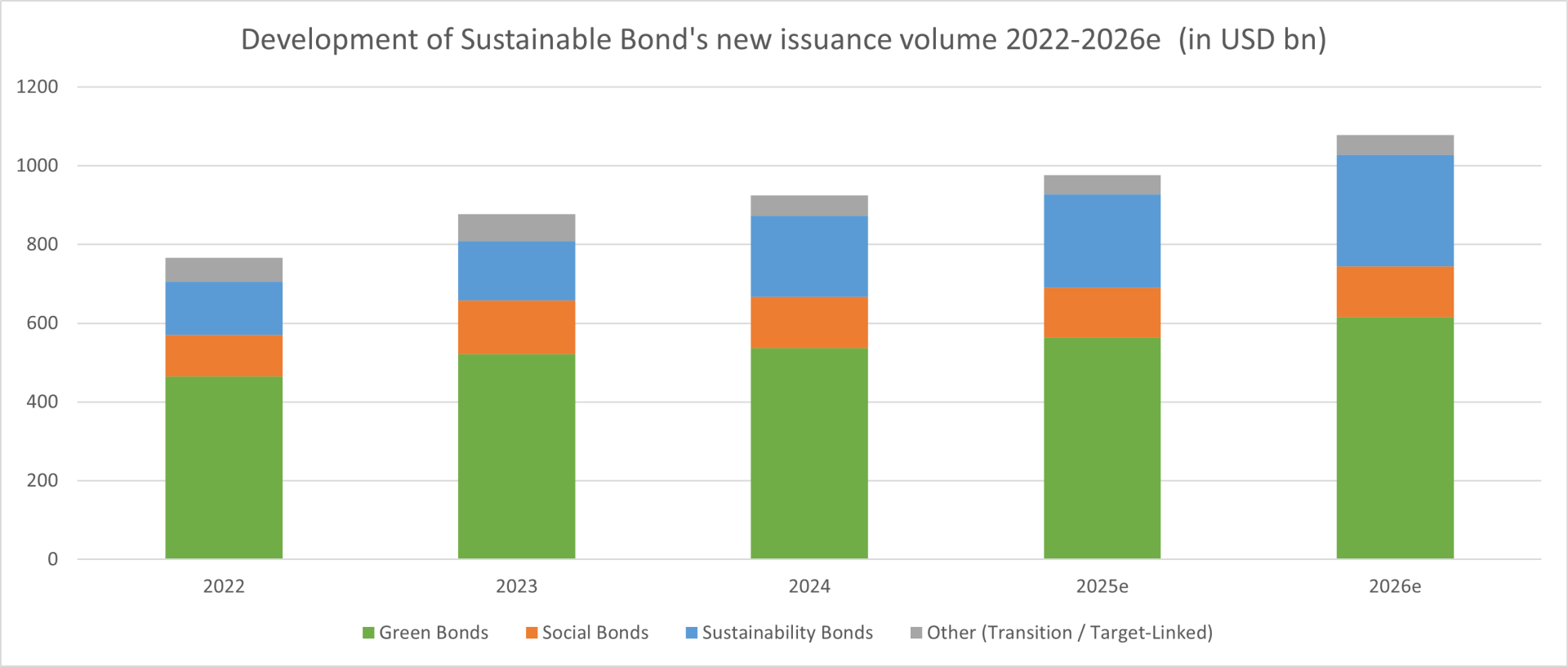

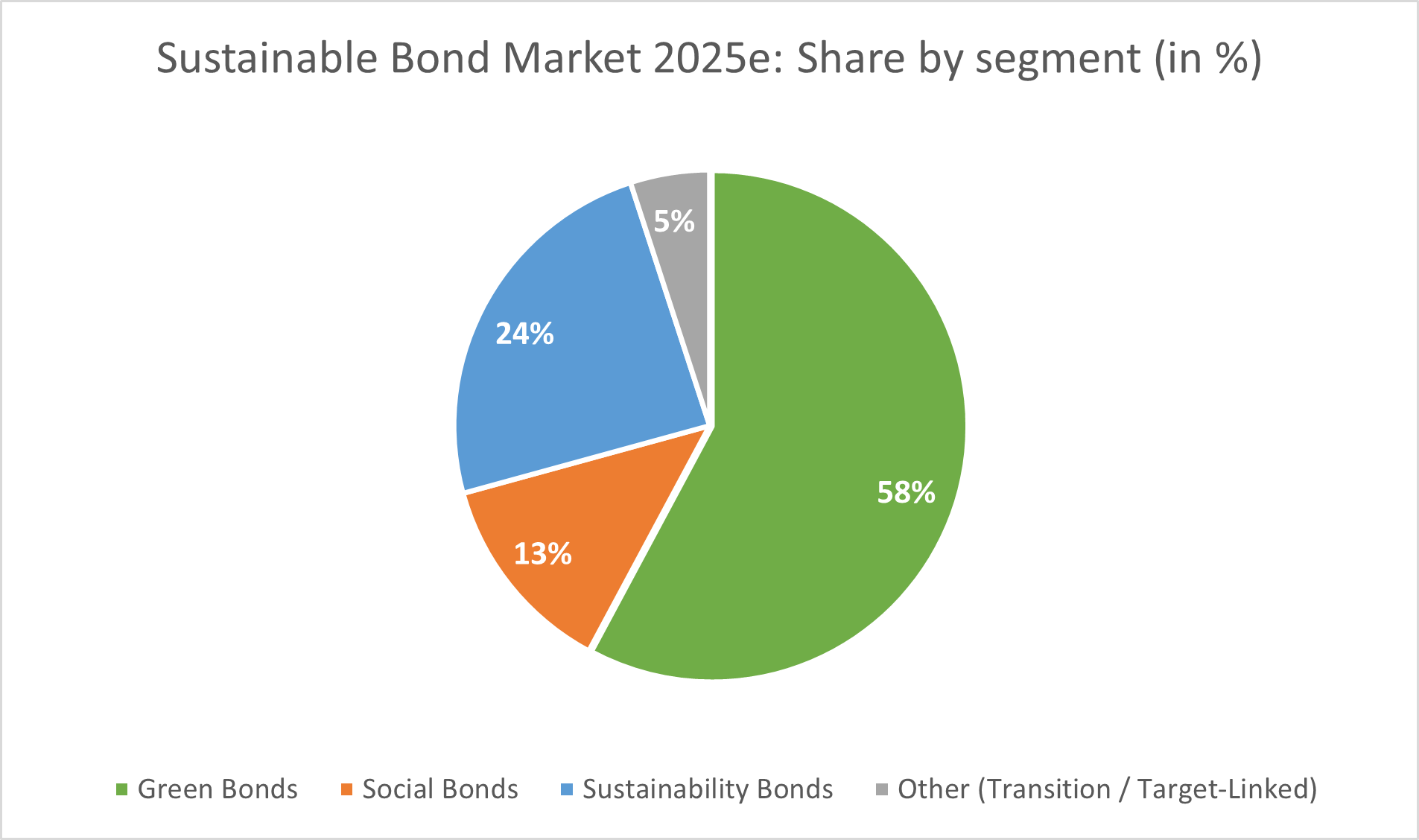

In 2025, we expect the Sustainable Bond market to move broadly sideways. We forecast new issuance to reach around USD 975bn, rising by just over 5% compared to 2024.

While the new issuance volume of Green and Sustainability Bonds is likely to increase for the reasons outlined above, we expect a slight decline in the issuance of Social and Sustainability-Linked Bonds. The growth of the former is limited by a lack of benchmark size projects. As for the latter, there is still a lot of skepticism in terms of materiality, ambition and hence credibility. Transition Bonds are likely to remain at 2024 levels, driven mainly by Japanese Government issues.

Green Bonds will remain the dominant segment of the market with a share of 58%. After the successful debuts of A2A and Île-de-France Mobilité, we expect further bonds to be aligned with the European Green Bonds Standard, but not a major wave for the time being. It remains to be seen whether the new standard will find the desired acceptance among issuers and investors and whether it will be able to establish itself as the gold standard over the established ICMA Green Bond Principles. The share of Sustainability Bonds will continue to grow.

From 2026 onwards, when the controversial debate on Sustainable Finance, fueled by critics, will have receded into shallow waters, we expect issuance to pick up significantly and double-digit growth to return.

Investor appetite for Sustainable Bonds will remain strong, driven by the underlying fundamentals of the market, the unwavering global drive for sustainability and the enormous opportunities presented by the sustainable transition. Hence, in terms of order books, the following will still apply in 2025: There will still be too much demand chasing too little supply.

Stay up to date on Sustainable Finance

Did you miss an issue? In our archive you will find all the previous editions of the Bulletin

Our initiative for the markets of tomorrow

The Sustainable Finance market is characterised by innovations, both in structural and technical terms. With our innovation projects "ESGlocate" and "KPI Library", we at DZ BANK contribute to the further development and standardisation of the market and offer our customers innovative solutions for specific challenges within the issuance process. In doing so, we set new standards in the market with our ideas for solutions for both structuring (KPI Library) and placement (ESGlocate).

More and more issuers are using the option of a sustainability-focused allocation process as they are interested in putting a sustainable exclamation mark at the end of the value chain of a Sustainable Bond transaction. ESGlocate is an innovative, data-based ESG scoring tool used by investors in the context of Sustainable Bond transactions.

DZ BANK has recognised the dynamics in the Sustainable Finance Market and launched the DZ BANK KPI Library, an innovative project for issuers of so-called Target-Linked structures. Based on the economic sectors in which the issuer is active, the KPI Library provides a list of possible key performance indicators (KPIs) that could underlie such a transaction. The guidelines of the ICMA Sustainability-Linked Bond Principles, the Sustainable Development Goals of the United Nations and the EU Taxonomy, among others, serve as orientation.

Your added value

Support for numerous inaugural transactions as well as transactions of regular issuers. In 2024: 34 Green, Social, Sustainability and Sustainability-Linked SSD transactions of more than EUR 23 billion for SSAs, FIGs and Corporates.

One of the most established bookrunner track records among German banks since 2007. DZ BANK is one of the leading European dealer banks in its core market for Sustainable Bond transactions (Green, Social, Sustainability and Sustainability-Linked Bonds).

DZ BANK-USP: Sustainable Investment Research with a unique ESG analysis and rating methodology; strong relationships with SRI investors in the cooperative network and beyond.

DZ BANK as an innovator in the ESG market: ESGlocate – sustainability-focused allocation of Sustainable Bonds; KPI Library - comprehensive KPI database for issuers of Target-Linked transactions; FrameNow - Automated construction kit that supports and accelerates the creation of

Sustainable Finance Frameworks.

Regular Sustainable Finance publications on structural background, market developments in the Sustainable Bond segment and the regulatory environment as well as upcoming events.

Further development of the Sustainable Finance market: DZ BANK is involved in numerous national and international initiatives and working groups to strengthen and further develop the market for Sustainable Finance.

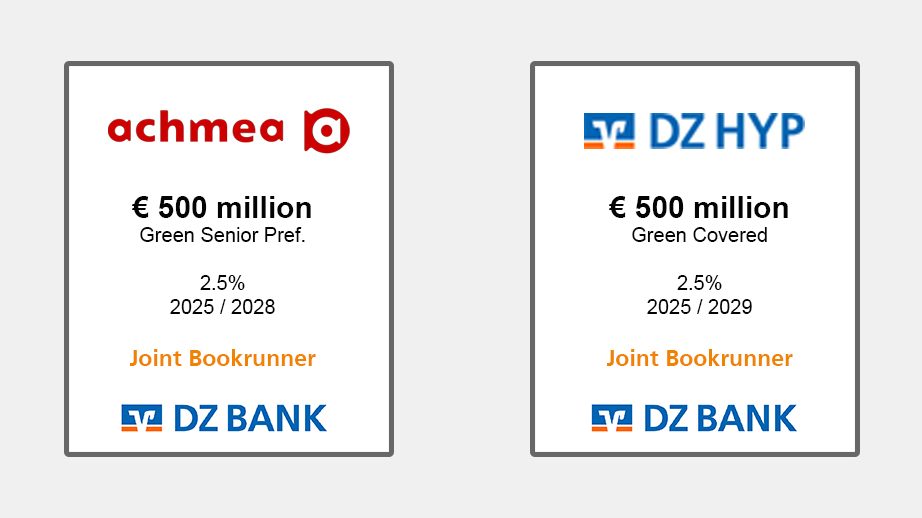

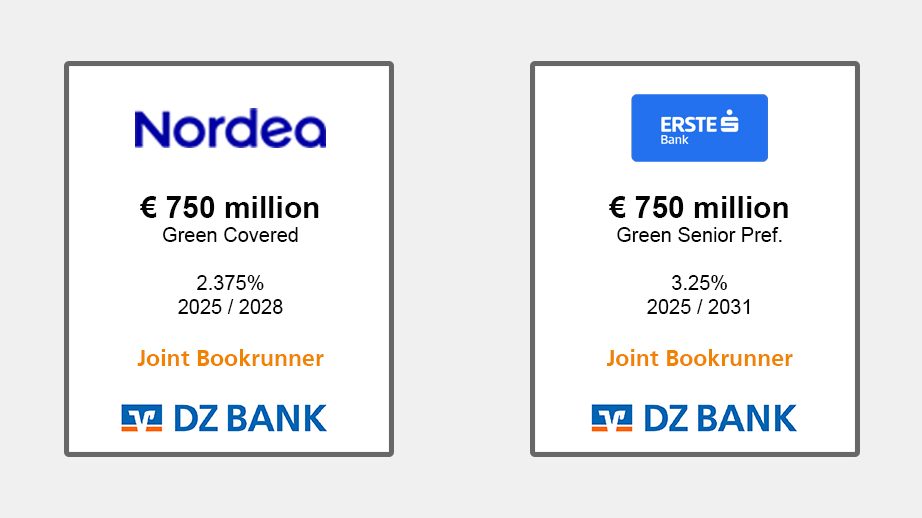

Successful placements for ESG issuers

Selected structuring mandates since 2022