DZ BANK Research – Outlook for 2026

Impact of tariffs cushioned by fiscal spending / German growth a mere flash in the pan without reforms / Stock markets rally – no AI bubble / DAX to reach 27,500 points

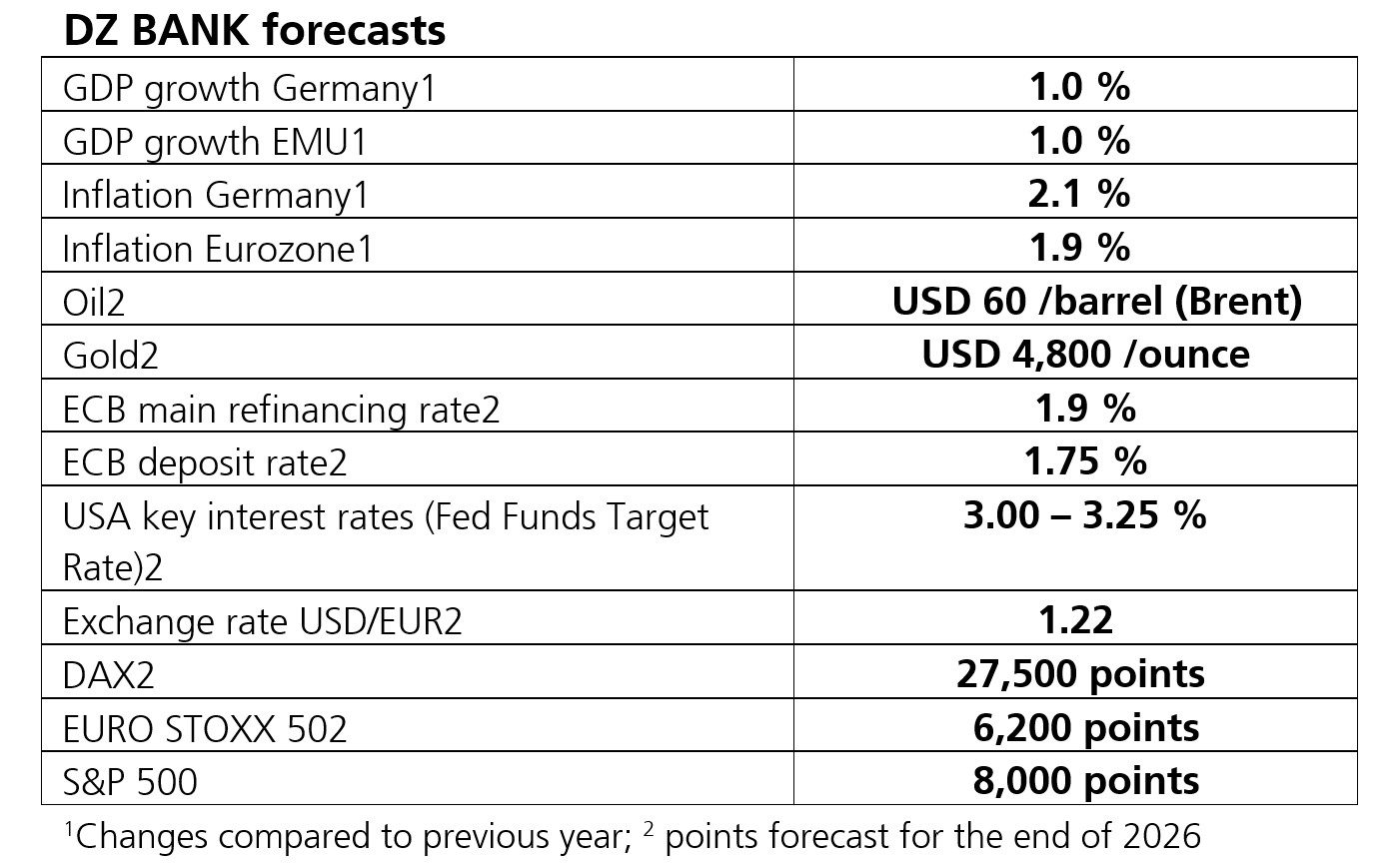

In spite of increasing restrictions on free trade, the global economy should prove robust in 2026. DZ BANK analysts expect three per cent growth. Increased fiscal spending in many countries is one of the reasons why the tariff dispute is not having such as strong impact. Although the German economy is expected to grow by one per cent, fundamental reforms are essential. Inflation in Germany and in the Eurozone should remain under control, mainly on the back of slower wage growth and cheaper energy prices. After a further 25 basis point rate cut in December, the ECB is likely to keep rates unchanged next year and remain in neutral territory at 1.75 per cent. The Federal Reserve should also reach a neutral interest rate level, a fact which should lift stock markets. Analysts are forecasting that the DAX will reach 27,500 points by the end of next year and the S&P 500 8,000.

US GDP is expected to grow by 2.3 per cent in 2026, according to DZ BANK analysts. Jan Holthusen, Head of Research and Economics, says that the economy under Trump has been surprisingly successful so far.

Tax cuts and investment incentives making the US attractive as a location

In the short term, however, the US economy is likely to struggle more, mainly reflecting a deterioration in consumer confidence. Many consumers are rattled by the tariff policy. In addition, there are problems with job creation. Over the course of next year, however, this trend should be offset by the willingness of companies to invest. One major reason for this is the One Big Beautiful Bill Act. Although there are social imbalances in the bill, it nevertheless improves conditions for companies to invest. The US economy will also be bolstered by small-scale spending: According to the economist, investment in computer hardware and software amounted to USD 338bn in Q2 2025 alone.

On the consumer front, the economic package could dampen the detrimental impact of tariffs somewhat. Income from overtime and tips, for example, will be tax free up to a certain amount. Subsidies on vehicle loans have also been introduced. On the downside, the measures will lead to a sharp increase in the national debt. Inflation in the US is also set to rise– from probably 2.9 per cent this year to 3.3 per cent next year.

Eurozone: Boost from state spending and internal demand

In spite of the tariff deal with the US, increasing protectionism worldwide is weighing on the export-oriented continent. DZ BANK analysts are projecting growth of one per cent for the Eurozone with the economy likely to pick up more strongly from the second half of the year. By then, Germany’s fiscal package above all should be having a positive impact and this should also bolster internal demand in the Eurozone.

Growth in Germany: no sustained upturn without reforms though

The German government has introduced a Special Fund for Infrastructure and Climate Neutrality to counteract the dire state of the economy and changed conditions. DZ BANK analysts are projecting GDP growth of one per cent for Germany in 2026. “Additional debt of over EUR 500bn in the next 12 months is a considerable amount. The package of measures makes sense since Germany currently hardly has any defence capacity and in view of the crumbling state of the country’s infrastructure. However, if those in charge choose to use the money merely for patching-up purposes – above all for short-term goals – it will all be a flash in the pan”, according to Jan Holthusen.

“So far, there is little evidence of the autumn of reforms. Germany will have to redefine performance and work incentives. Although the new guaranteed basic income is a first step, a reduction in the standard rate and simultaneous increase in the current tax-free allowance would make more sense. We must get back to a state where it pays to work, above all at the lower end of the scale “, says Holthusen. Pension cuts are also inevitable. “The German government wants to maintain the pension level at 48 per cent for the longer term, even though fewer and fewer people are paying into the system – which means that the state top-up keeps on increasing. In addition, employee and employer contributions keep on rising.” For Germany to become more attractive once again as a location in which to do business, employees would have to work for longer or the pension level would have to be reduced. Holthusen believes energy prices are moving in the right direction: “The planned industrial electricity price which will apply to as many as 2,000 energy-intensive companies is a major boost. Another positive factor is that, from next year, the electricity tax for the manufacturing sector as well as agriculture and forestry will be permanently reduced to the European minimum level.” However, Holthusen criticises the fact that the retail and services sectors are being left out.

Less restrictive: Fed follows the ECB to neutral ground

The ECB is likely to cut interest rates by 25 basis points in December. Given a deposit rate of 1.75 per cent, this will bring rate cuts to an end for the time being. “We do not expect any rate cuts next year. Inflation in the Eurozone should even fall below the central bank’s target of 1.9 per cent”, according to Christoph Kutt, Head of Fixed Income Research. The stable price trend mainly reflects weaker wage pressure and declining service prices. In addition, a strong euro is leading to cheaper imports and energy prices. “The Fed is following suit and should also reach a neutral key interest rate next year. Kutt indicates that the range should fall from the current 3.75 to 4 per cent to 3 to 3.25 per cent. The Fed thereby aims to counteract a weakening labour market.

Sovereign risk premia rising: corporate bonds more attractive

Safe benchmark sovereign bonds such as US treasuries and German government securities are likely to become less attractive to investors in 2026. “We expect a yield of 4.4 per cent for ten-year US bonds by the end of 2026“, says Christoph Kutt. This is a slight increase, reflecting an uptrend in risk premia. “This mainly reflects an ever-growing debt”, explains Kutt. There is a similar picture in Europe. “Germany’s debt is increasing, and France has been under pressure for some time from the point of view of economic policy. To obtain fresh funds, both countries are issuing more bonds – supply is growing”, says the analyst. DZ BANK Research expects a ten-year Bund yield of three per cent by the end of 2026. According to Kutt, this will make investment-grade corporate and bank bonds even more attractive for investors next year: “Although the performance of corporate bonds also depends on policies in various countries, top firms have diversified business models and supply is smaller than in the public sector.” Investment-grade paper currently delivers a yield a around 3.4 per cent. “We expect a total yield of around 3.5 per cent in 2026.”

New records: stock markets buoyed by fiscal measures and AI

Despite trade policy tensions, global stock markets have done well in 2025 and Sören Hettler, Head of Investment Strategy and Private Clients, does not expect to see this resilience coming to an end next year. “The huge impact which individual politicians can have on the markets was clear on Liberation Day. However, the slump in share prices was brief. In most cases, upheavals triggered by economic policies were overcome with tariff agreements, which will help companies next year.” Hettler expects two-digit growth rates from the big indices in 2026 as well. He is forecasting 8,000 points for the S&P 500 and 27,500 points for the DAX.

These good prospects mainly reflect monetary and fiscal policy in the US and Europe. The “Fed and ECB should coincide in neutral interest territory in 2026. This should make it easier for companies to project financial conditions. Moreover, the Fed will end its balance sheet winddown”, says Hettler. On top of that, there will be expected earnings; earnings growth for the leading US index is projected at 14 per cent.

AI is set to play a crucial role in the success of the stock markets. Microsoft, Amazon, Alphabet and Meta alone are expected to increase their investment to over USD 400bn in 2026. However, Sören Hettler does not anticipate any bubble forming: “The bulk of this investment will be used to develop physical infrastructure, including the construction of highly specialised data centres.” This investment will therefore also have a positive impact on other sectors, including energy supply, construction, chip manufacturing, and banks. “A difference in relation to past bubbles, moreover, is the fact that many tech firms are very liquid and that they can mostly invest from own funds. If anything, even in the event of a strong market correction, combined with the development of a lasting infrastructure, there would still be asset value,” Hettler stresses. The risk would then be not so if, but rather when and how much the investment might yield in real terms.

Europe’s main growth drivers are defence spending. “German companies with expertise in military vehicle and systems technology, aviation and defence IT are set to benefit in 2026, explains Sören Hettler. This is likely to be a lasting trend. NATO countries are planning to spend five per cent of their GDP annually on defence up to 2035. Next year, attractive stocks in the Euro Stoxx 50, apart from defence stocks, will mostly be in the financial and utilities sectors, according to Hettler. German indices will be helped not only by more favourable global conditions and state investment in defence, but also by the German government’s infrastructure package. Although the small MDAX and SDAX indices are mainly dependent on the German economy, the German leading index with its global outlook nevertheless includes groups which will benefit from a local upturn and an improvement in Germany’s competitiveness as a business location. Looking at individual sectors in the DAX, apart from the industrial and defence sector, technology companies and the financial sector should also get a boost.

Broad diversification is still an important factor. This is also a reflection of the euro. “The common currency is strengthening against the US dollar. This will have to be factored in with any exposure outside the Eurozone”, says Hettler. In addition, gold will remain exceptionally attractive for investors. DZ BANK is forecasting a price of USD 4,800/ounce by the end of next year.